Each merchant needs to exchange Candlestick pattern PDF with benefit. To get the benefit they utilized various markers and those pointers help them to think about value patterns, quality, and numerous different things. Today, I will educate you regarding the candle inversion design pointer that what is candle inversion design marker and how it causes you to get benefit in your exchange?

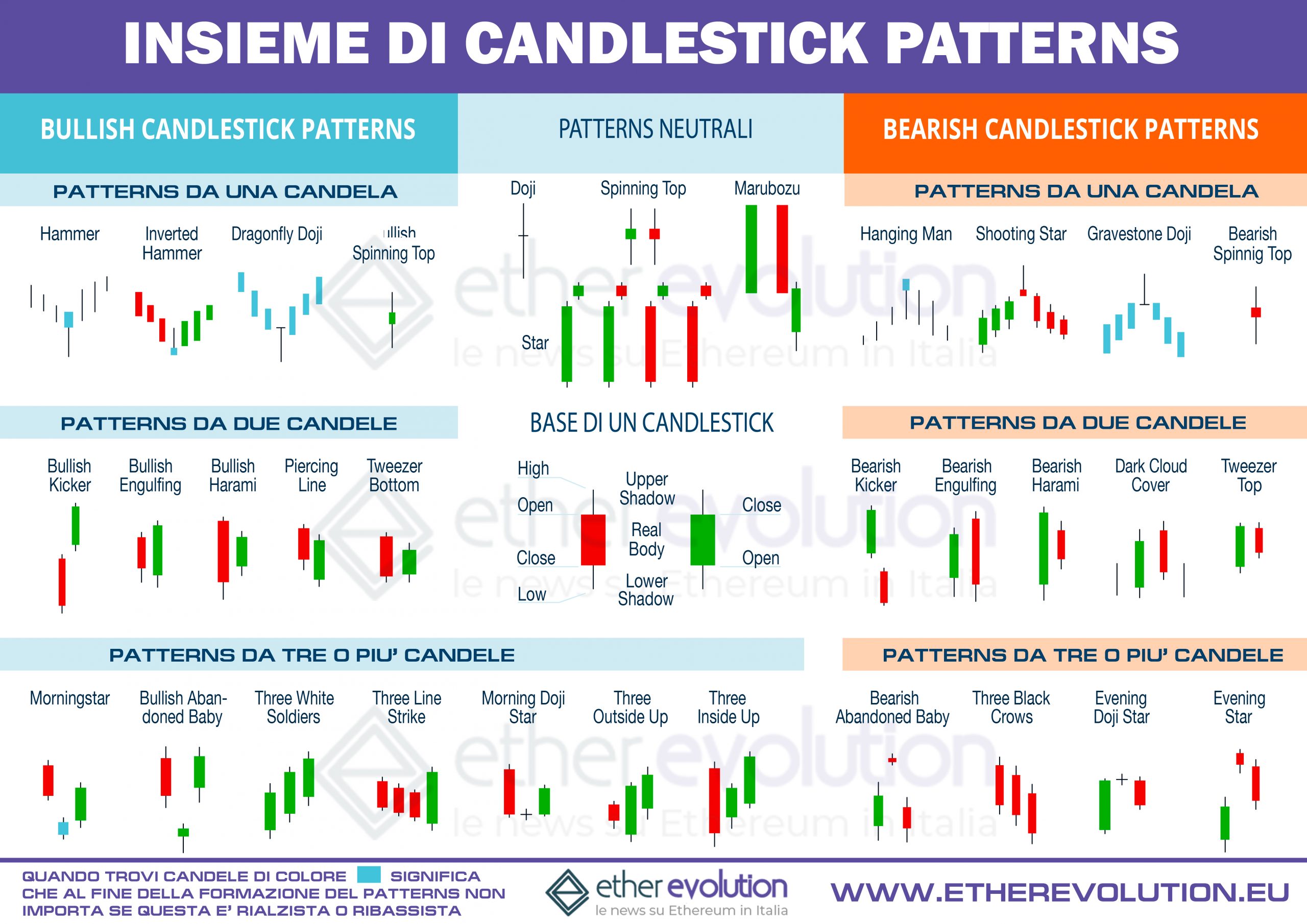

A candlestick depicts the battle between Bulls (buyers) and Bears (sellers) over a given period of time. Through Japanese Candlesticks, the market signal that shows the battle between the Bulls (buyers) and the Bears (sellers) over a certain amount of time. By knowing how to read candlestick, you will know which direction. Once you’re used to candlestick charts – you won’t look back. Candlesticks are now such a familiar part of our trading scenery, it’s hard to believe that only 20 years ago, they were a strange and mysterious import from Japan. Understanding the clues candles hold One of the best things about the clues we find in candlesticks is that they. THE CANDLESTICK TRADING BIBLE What is a candlestick? Japanese candlesticks are formed using the open, high, low and close of the chosen time frame.If the close is above the open, we can say that the candlestick is bullish which means that the market is rising in this period of time. Bullish candlesticks are always displayed as white candlestick.

To comprehend candle pointer you need to require significant investment and gain proficiency with all the candles designs in the marker. candlestick pattern indicator is a pointer that informs you regarding what’s going on in the candle outline whether the cost is close to excessively high or it is going close to low.

How to Read Candlestick Charts PDF?

This marker likewise causes you to know how the candles change when the cost is slanting high or low. In the wake of utilizing such a large number of candle pointers, we came to convey that this marker is the best pointer that tells about candle conduct.

In a week after a week, this pointer just shows two inversion designs. One is Bullish sledge and the subsequent one is Bearish overwhelming.

Forex Candlestick Chart Patterns PDF

This candle pointer has bullish and bearish examples. The bullish example shows the upturn of candle designs and the bearish example demonstrates the downtrend of candle design. There are 18 standpoints for the bearish and bullish example in the pointer which are given beneath:

1. Bullish Hammer:

A hammer is a candlestick pattern that plots on the indicator chart when the security trades are low than openings. This pattern draws hammer-shaped candlestick pattern in which shadows are at least twice the real size of the pattern body. Hammer has a small body, it occurs when the price is dead.

2. Morning star:

It is a visual pattern that has three candlesticks. It follows a downtrend and it indicates the startup of an upward climb. It is a sign of a reversal candlestick pattern. It is made up of tall black candlesticks that have short bodies and long wicks. One of the morning stars captures the moment of the market.

3. Bullish engulfing pattern:

This candlestick has two reversal candles. The second candlestick pattern engulfs the body of the first candlestick. It appears in a downtrend pattern. It helps to make reliable trade. It forms a pattern when the small candle is followed by the large one.

4. Piercing line pattern

It is a two-day trading pattern. It forms short term reversal price patterns. It can be used for only five days. It detects the downtrend, gap and strong reversal pattern. It works with only short term traders. It helps to trade better. It can detect the gap of overnight.

Bullish Candlestick Patterns PDF

5. Morning doji star

It is a bullish candlestick pattern. This pattern is similar to the morning star pattern. It also consist of a long bearish candle, it has characteristics to gap down between different candlesticks. It consists of three bodies, the first stick has long black bod, the second bar opens it open near the lower point and the last one is for the final midpoint of the candlestick pattern.

6. Shooting star

It is a type of candlestick pattern which opens when the security opens in the market trend. It is a bearish trend because price rises many times during a day but the sellers push the price back at its original place.

7. Evening star

It is a stock price candlestick pattern.it is used for technical analysis when the trend is going for a reversal pattern. It also contains three bodies, a large body, a small body, and a red body candle. It is related to up trend and downtrend in the market trend. It is used to detect future price lines. This pattern is also a reliable technical trend pattern. This star is opposite to morning star. One of them is bullish and the other one is bearish.

Candlestick Reversal Patterns PDF for Beginners

8. Bearish engulfing star

The bearish engulfing pattern is used to detect the lower range in the price movement. This pattern has white, green, black, and red candlesticks. It is an important pattern because it tells the overbought and oversold range in the market trend. This pattern can be created anywhere in the market trend.

9. Evening doji star

This pattern consists of a bullish trend. It has a long bullish candlestick. The first two candles act as bearish candlesticks. This pattern is similar to the evening star pattern. It creates a gap between the candlestick bodies.

10. Dark cloud pattern

It is a bearish reversal pattern used to show changings in the momentum of the market trend. This indicator is made up of one bearish candle and one bullish candlestick that close above the midpoint. Program proiectare mobila free download. It shows the declining prices and confirmation of declining of the price.

On the off chance that you are exchanging with this pointer, at that point, you have an excessive number of opportunities to pick up the benefit yet to get the benefit you have to comprehend this marker and need to concentrate on the candles and conduct of candles.

How to Understanding Candlestick charts PDF

This indicator has numerous utilizations some of them are referenced here. It filters the outline naturally, it doesn’t make a difference which period is chosen on the diagram. It shows the specific example of whether the candle’s arrangement is as a Night star, Morning star, meteorite, Bearish overwhelming, or Bullish immersing day trading chart patterns pdf.

Technical Analysis Chart Patterns PDF

Trading With Candlesticks Balkrishna Pdf Download

The candle examples can without much of a stretch be clarified by the client as it shows a candle design of the left half of the pointer graph. It has one increasingly explicit utilizations that show a truncated example on the diagram. On the off chance that the shortened example is over the candles, at that point,

the outline shows a bearish example and on the off chance that the contracted example is underneath the candle, at that point it demonstrates a bullish example.

It doesn’t make a difference where period you are exchanging, this pointer gives you light inversion design in whenever outline on your graph. You can utilize a bullish inversion candle design just when the cost is an upturn. You can utilize a bearish inversion candle designs just when the cost is in a downtrend. You can utilize doji and immersing examples to see the turning around the pattern of the pointer.

Download

Author: Steve Nison

Author: Steve NisonPublisher: John Wiley & Sons

Trading With Candlesticks Pdf

ISBN: 9780471464884

Size: 41.93 MB

Format: PDF, Docs

View: 4618

Get Books